Irs 1040 Schedule D 2025

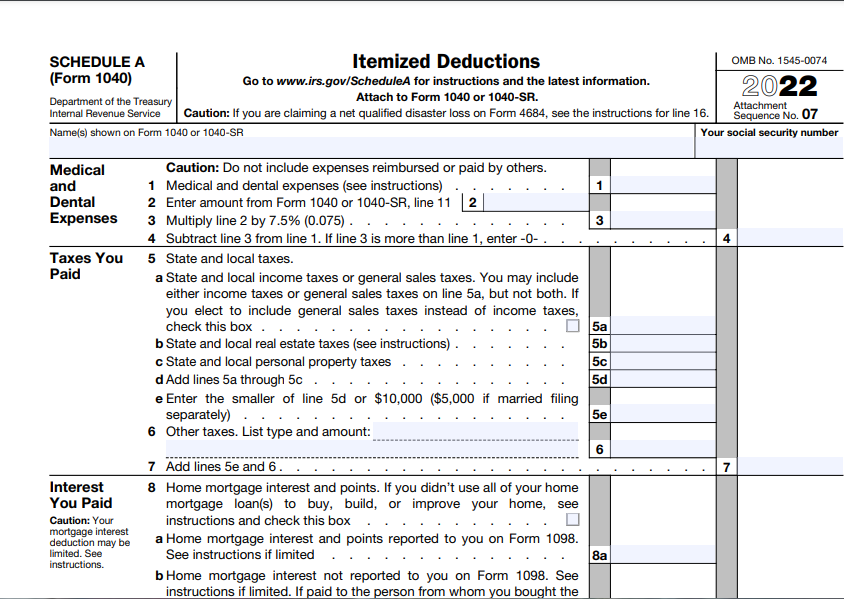

Irs 1040 Schedule D 2025 - All About Schedule A (Form 1040 or 1040SR) Itemized Deductions, 22, 2025, the irs announced the annual inflation adjustments for 2025. 1040 Schedule 1 2025 2025, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

All About Schedule A (Form 1040 or 1040SR) Itemized Deductions, 22, 2025, the irs announced the annual inflation adjustments for 2025.

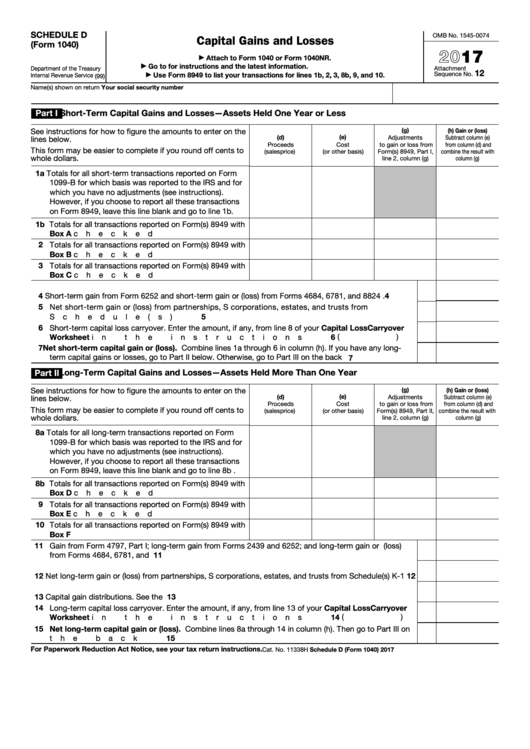

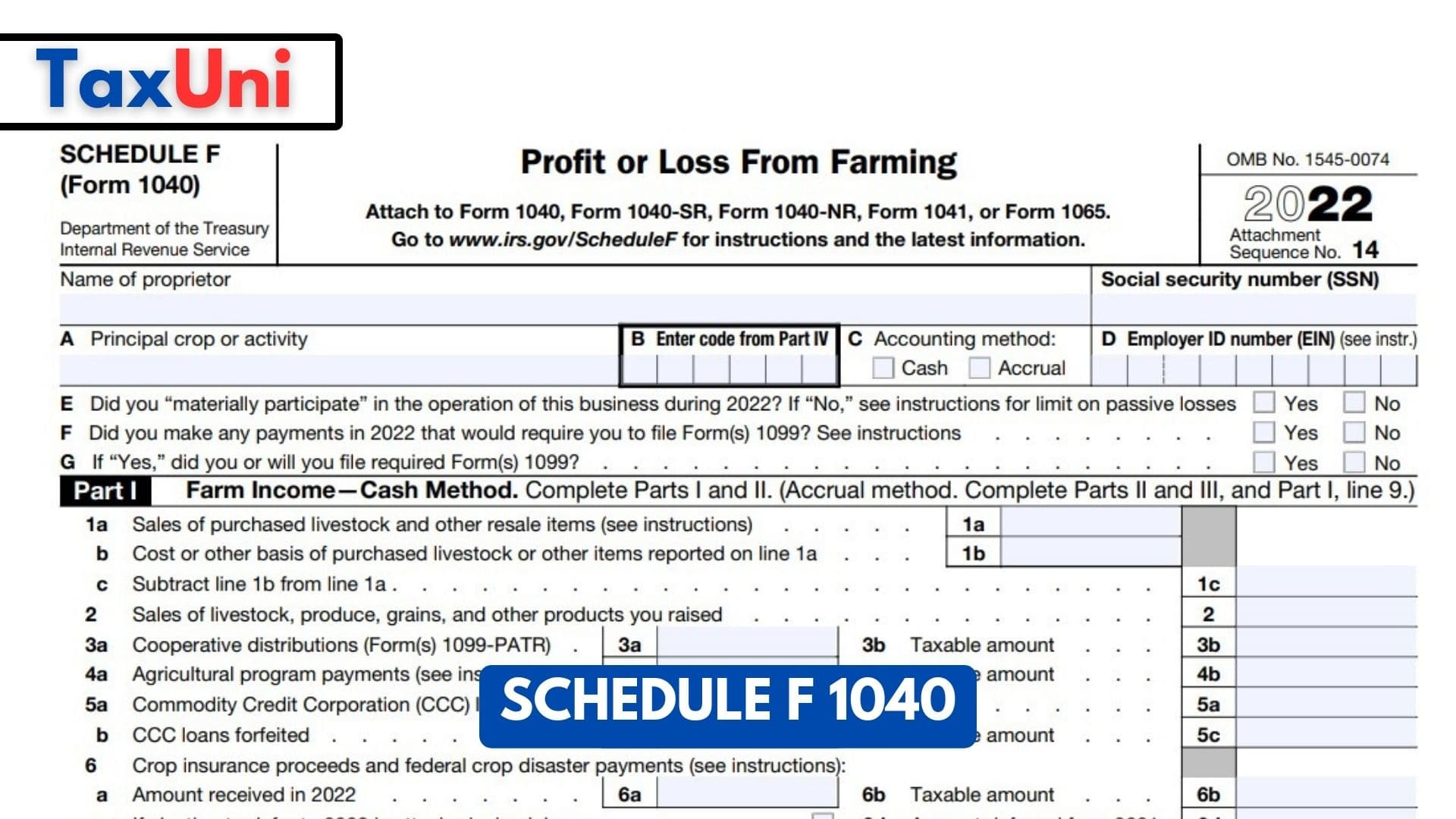

Form Schedule D (Form 1040) For 2025 A Comprehensive Guide Cruise, Schedule d is a tax form filed with irs form 1040 that reports the gains or losses realized from the sale of capital assets.

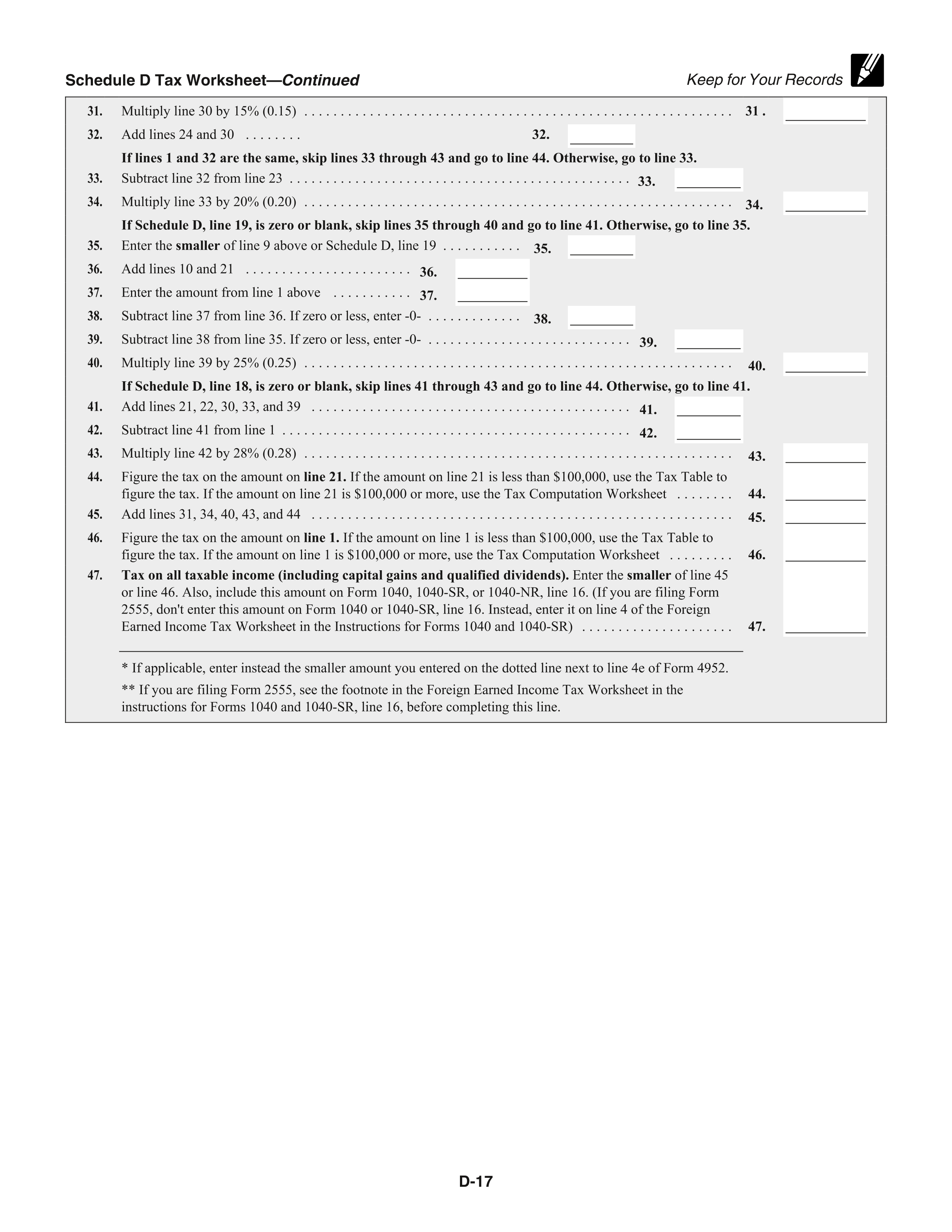

Download Instructions for IRS Form 1040 Schedule D Capital Gains and, Use one of these worksheets to calculate your required minimum distribution from your own iras, including sep iras and simple iras.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

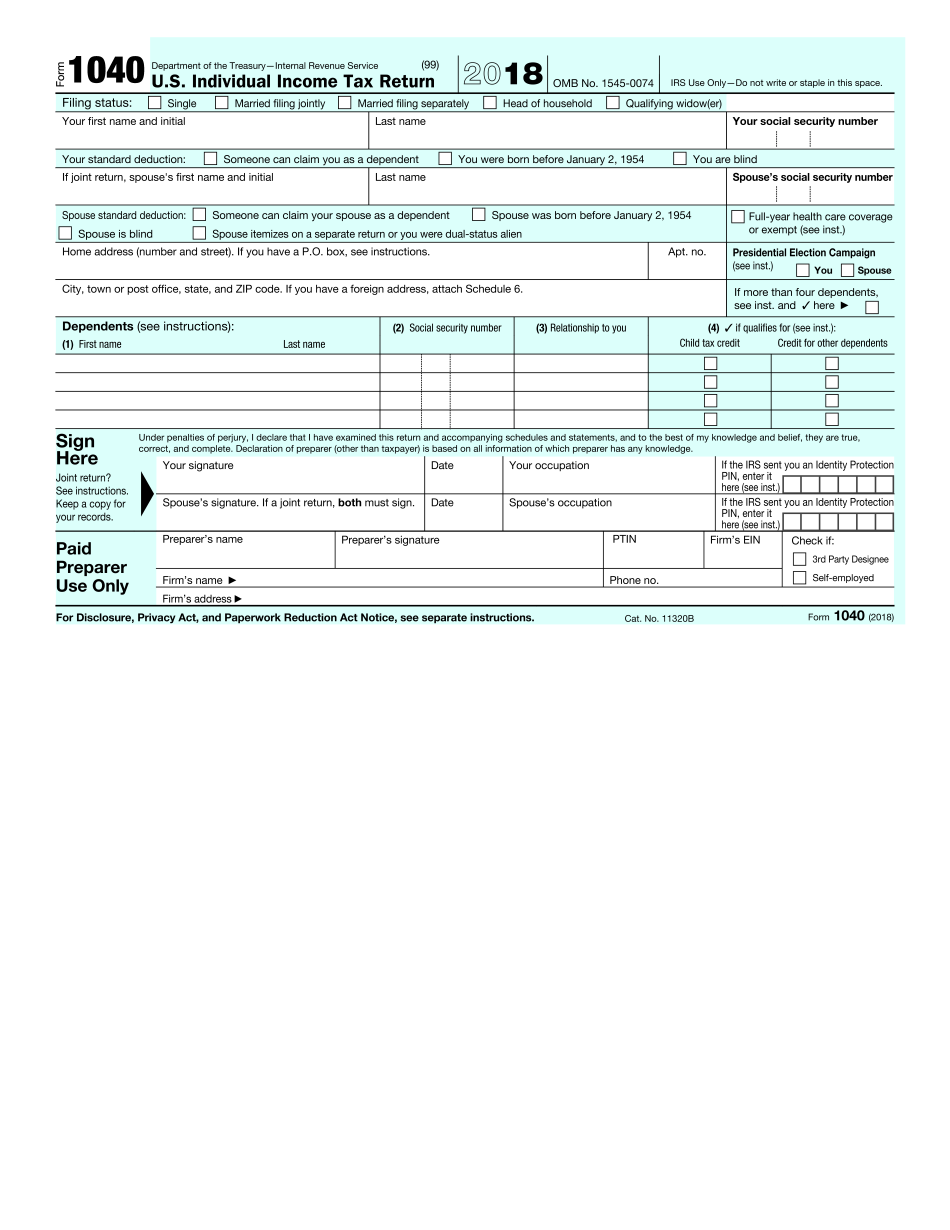

Irs 1040 Schedule D 2025. April 15, 2025, marks the deadline for filing your form 1040 and paying any taxes owed. Based on your projected tax withholding for the year, we can also estimate your.

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

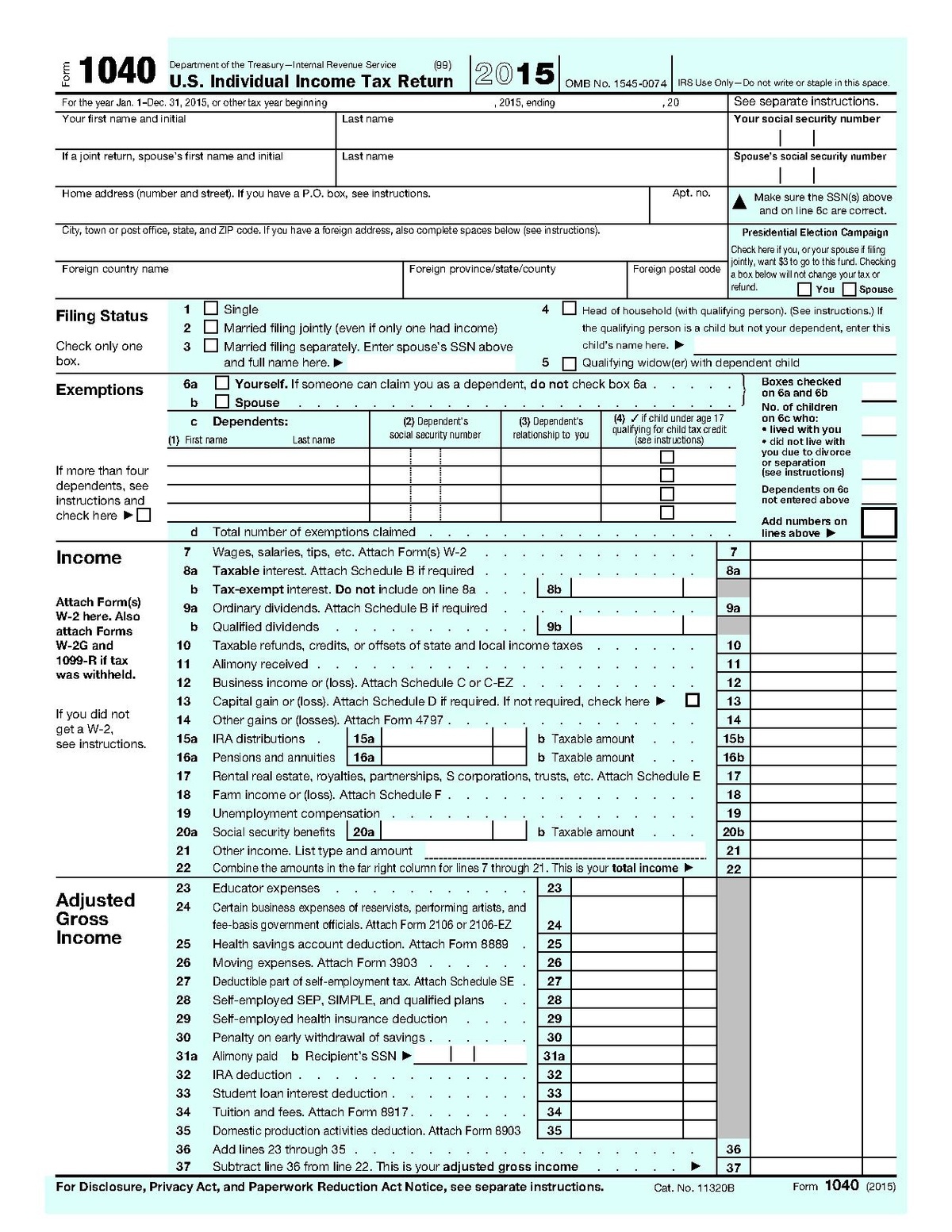

IRS 1040 Form Fillable Printable In PDF 1040 Form Printable, 22, 2025, the irs announced the annual inflation adjustments for 2025.

2025 Instructions For Schedule D Sam Leslie, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

You use schedule d to report. To report capital gains on your tax return, use schedule d to detail your gains and losses from the sale of assets.

IRS 1040 Schedule E 2025 Fill out Tax Template Online US Legal Forms, The irs requires you to report your capital gains and losses on.

2025 Schedule A Form 1040 Hannah Kaylyn, Use one of these worksheets to calculate your required minimum distribution from your own iras, including sep iras and simple iras.

Fillable Schedule D (Form 1040) Capital Gains And Losses 2025, The net capital gain or loss is.